|

|||||||

|

“I want to thank you for the overall excellent job you and your people do at CDx3; I am a newer subscriber and have really benefited from following your advice. You can count on me being a long term subscriber because you cover this part of the market better than anyone else." - Charles H., CDx3 Notification Service subscriber |

In This Issue... | ||||||

|

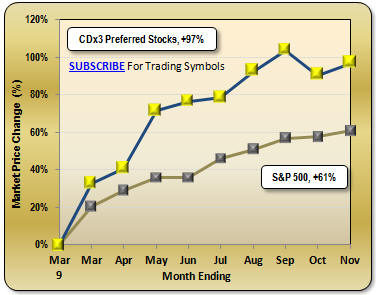

The Third Edition of Preferred Stock Investing, published this summer, includes all of my latest research regarding the market price behavior of high quality preferred stocks. Five new chapters and 70 additional pages use real preferred stocks to show you how to screen, buy and sell the highest quality issues, even during a Global Credit Crisis. Chapter 15 lists all qualifying preferred stocks that have been issued since January 2001 and shows you how you would have done by using the investment method described throughout the book for each one. And the book includes all of the web sites and other resources that are used to implement the CDx3 Income Engine on your own. The Third Edition of Preferred Stock Investing, the manuscript of which was reviewed by several dozen readers and subscribers before going to the publisher, is my most comprehensive work yet and it is now available at your favorite online retailers (see retailers). Just Posted On The Preferred Stock Investing Reader's Forum: The trading symbols of common stocks are standardized; you can enter "PSA" into any online quote or broker system and get the current market price for Public Storage. The trading symbols for a company's preferred stocks, however, are not standardized. They vary depending on which quoting system you are using. In a November 20 post to the Preferred Stock Investing Reader's Forum (my "blog") titled "Preferred Stock Trading Symbol Cross-Reference Table" I clear up the confusion by showing you the preferred stock trading symbol conventions used by various popular online systems. (jump to Forum) In the Last Month's CDx3 Investor Results article I use three charts to show you where investors have been re-investing their money during this current market recovery and how far we have yet to go. As impressive as the market recovery has been since March 9, 2009, only half of the investor cash that was pulled from the market during the Global Credit Crisis has returned. The rest is still sitting in brokerage cash accounts waiting to come back in. While the S&P 500 common stock index has increased an impressive 61% since March 9, the average market price of the highest quality preferred stocks has increased 97% over the same period. (jump to article) In this month's Special Announcement article I make you an offer that I have only made once before. If you use the "Buy Now" button within the Special Announcement article below to subscribe to the CDx3 Notification Service during December, you will also receive a free signed paperback copy of my book, Preferred Stock Investing, Third Edition. If you already have the book, receiving this second signed copy could make a great Christmas gift for someone on your list. The other links to the CDx3 Notification Service that you see throughout this newsletter will allow you to subscribe as usual, but using the "Buy Now" button in the Special Announcement article will also get you a free book. This offer is valid through midnight December 31, 2009 for new individual subscribers only. (jump to article) In the CDx3 Company Spotlight article I introduce you to Duke Realty Corporation. Duke is doing some very creative things to face a very difficult real estate market. In this article I show you how Duke is quickly changing its portfolio from suburban office buildings to facilities tied to healthcare, including the new 450,000 square foot Baylor Cancer Center in Dallas, and export shipping in Savannah. And a few days ago Duke announced that it had succeeded in rescheduling the maturity date on a big chunk of its debt from this coming January to 2013. (jump to article) The CDx3 Question of the Month is presented both here and on the Preferred Stock Investing Reader's Forum. If you visit the Forum you can test your knowledge by clicking on your answer to the question. You will receive an automatic email that provides you with the correct answer and my explanation. Or you can just read the answer in the below CDx3 Question of the Month article. This month, I address one of the key differences between the interest you earn from a bond and the dividends you earn from a preferred stock. Specifically: "If you purchase a preferred stock on the last day of its 90-day dividend quarter, how many days worth of dividend income will your dividend payment be for?" (jump to article) Why wait until next month's CDx3 Newsletter to find out what is going on in the preferred stock marketplace? Throughout the month I post regular research articles on the Preferred Stock Investing Reader's Forum and make them available to you for free. In the Free Special Offer article below I provide you with a link that allows you to receive my posts, and the posts of other preferred stock investors, via an email message rather than having to visit the Forum to see what's new. Any time a new article is posted, you will receive a message in your email inbox automatically - free. (jump to article) Coming Up For Preferred Stock Investors: The beginning of a new year is always a good time to take a moment and ponder your investment portfolio. One of the many things I like about preferred stock investing is that, within a surprisingly short period of time, a portfolio of CDx3 Preferred Stocks benefits from the miracle of "compounding" where you start earning dividend income on your previously earned dividend income, much like a bank CD compounds its interest. In the Next Month's Sneak Peek article at the bottom of this CDx3 Newsletter, I provide you with a very interesting chart that shows how long it takes (in months) for a portfolio of CDx3 Preferred Stocks to become "self-funding;" the point where you are buying your next CDx3 Preferred Stock without any "new" money from you. Take a look at the chart. I think you'll be surprised at how quickly you can create a self-funding preferred stock portfolio using the highest quality preferred stocks - "CDx3 Preferred Stocks" - that are available today. (jump to article) I will provide you with more specific details regarding building a self-funding CDx3 Portfolio in today's preferred stock market in next month's issue of the CDx3 Newsletter. |

|

||||||

|

Half Of Pre-Crisis Cash Is Still Sitting In Brokerage Cash Accounts Three Charts Show Where The First Half Went And Where The Rest Is Likely To Go Next It is very important that preferred stock investors understand what is happening right now in the marketplace for high quality preferred stocks. While I have written to you about this before, I present three specific charts here that clearly illustrate how the Global Credit Crisis, and the recovery from it, has created a unique set of circumstances for preferred stock investors. As nice as the recovery has been so far, these data suggest that the market prices of high quality preferred stocks are positioned for additional gains (in addition to the great quarterly dividends that they pay). Three Stages Of Recovery While the duration and breadth of economic recoveries varies, recoveries usually progress in three stages: Stage 1: Stock Market Recovery - the stock market usually recovers first since investors are motivated to get in early. A number of studies clearly show that those investing in the earlier days of a recovery tend to earn higher rewards than those who invest later. Importantly, returning investors always start with the lowest risk alternatives - the highest quality bonds and preferred stocks; Stage 2: Real Estate Recovery - Patient home buyers finally give in to the temptation of low prices and low mortgage rates that come with economic downturns; and Stage 3: Jobs Recovery - labor costs are usually the largest single expense item for most businesses. Jobs usually recover last since employers are hesitant to make big, long-term commitments. Chart 1 shows the S&P 500 stock market index value for 2009. After reaching a low on March 9, we are obviously in Stage 1, Stock Market Recovery, illustrated by the 61% increasing in this index. While we are starting to see the first encouraging signs from the real estate market, no one is making the case just yet that things are back to normal there. And unemployment is still about 10% so Stage 3 is clearly a ways off. Follow The Cash Here's where this really gets interesting. We all know that the market has seen a spectacular recovery since March. While Chart 1 illustrates that recovery, that chart tells us nothing about how far we have left to go or what might be ahead. Is the market recovery over or just getting started? You can stare at Chart 1 for a long time without getting any hint at an answer to that question. That's where Chart 2 comes in. Chart 2 uses a metric that shows the amount of cash that investors have staged in their brokerage cash accounts waiting to be invested. When the market goes into a slump, we see investors sell off positions so their brokerage cash account balance goes up. Then, as investors feel like the market is in recovery, they start buying securities (starting with the highest quality bonds and preferred stocks) and their brokerage cash account balance goes back down. Once those brokerage cash account balances return to pre-slump levels, we can conclude that the effect of the slump has passed and the market has recovered to where it was. Put another way, by measuring how much cash is still stashed in those brokerage cash accounts, we can get an idea of how far the recovery has yet to go. And that's what Chart 2 shows us. It shows how much cash (as a percentage of total market capitalization) is still sitting in brokerage cash accounts, waiting to be invested. You can see that the pre-Global Credit Crisis value of this metric was about 16% on average. In March 2009, when the market was at its bottom, this metric had risen all the way to 48%, almost doubling the previous high set during the 2001-2002 recession that resulted from the 2001 terrorist attacks. But the real message from Chart 2 is that only about half of the cash that was withdrawn from the market during the Global Credit Crisis has been returned. The current value of this metric is about 32%, double the pre-crisis 16% value. The implication here is that only half of the cash that investors pulled out of the market during the Global Credit Crisis has been reinvested; the remaining half has yet to come back into the game. Impact On The Preferred Stock Market The S&P 500 index measures the market price performance of a sample of publicly traded common stocks. As impressive as the 61% increase in the S&P 500 has been, take a look at Chart 3. As I have written to you throughout this year, during a recovery investor cash comes back into the market in order of perceived investment risk, starting with the lowest risk alternatives - the highest quality bonds and preferred stocks. Chart 3 shows you exactly what I've been telling you about. While the 61% increase in the S&P 500 common stock index is impressive, Chart 3 clearly shows where the money is really going. The market price of the highest quality preferred stocks - "CDx3 Preferred Stocks" (see sidebar at the top of this newsletter) - has risen an average of 97% over the same period. Nearly double in less than nine months. Opportunity For Preferred Stock Investors As they have returned massive amounts of cash to the market, Chart 3 shows that investors have greatly favored the highest quality preferred stocks - CDx3 Preferred Stocks. And, as illustrated in Chart 2, half of their brokerage cash has yet to be put toward purchases. If the first half of this investor cash pushed the market prices of CDx3 Preferred Stocks up by an average of 97% when investors returned it to the market, what do you think is going to happen as the second half of this cash continues to come back in? I would be very surprised if the remaining half of investor's cash, when returned to the market, makes market prices go down. These three charts clearly illustrate that (a) we are in Stage 1 of a recovery, (b) only half of pre-crisis investor cash has returned to the market so far and (c) that cash has gone into the highest quality preferred stocks in a big way, with the remaining half still to come. But Which Ones? Of the 1,000 to 2,000 preferred stocks trading every day, do you know how to identify the highest quality issues? Chapter 7 of my book, Preferred Stock Investing, provides the ten selection criteria that ordinary preferred stocks must meet in order to be considered the highest quality - CDx3 Preferred Stocks (the sidebar at the top of this newsletter provides you with an example of three of these criteria). For those who would rather someone else do the research and calculations for you, I offer the CDx3 Notification Service. Subscribers to the CDx3 Notification Service have their own web site that includes the CDx3 Preferred Stock catalog. The catalog identifies every CDx3 Preferred Stock issued since January 2001. In one click, subscribers can see the Moody's rating, CDx3 Spec Sheet, dividend calculations and schedules, get a current price quote and much more for each issue. And subscribers are notified by email when there are upcoming buying and selling opportunities for specific CDx3 Preferred Stocks. As we start a new year, position yourself for the next wave of investor cash that is about to re-enter the preferred stock market. Invest in the best. We do the research and calculations, you make the decisions. Please consider subscribing to the CDx3 Notification Service today. |

|

||||||

|

Free Copy Of Preferred Stock Investing For December Subscribers December Subscribers To The CDx3 Notification Service Will Receive Free Signed Paperback If you are reading this Special Announcement article before December 31, 2009 you are in luck.

Just click on the "Buy Now" button that you see below the image at right. No other web page or link within this, or any other, CDx3 Newsletter will get you this Special Announcement deal. To take advantage of this limited time offer you must use the "Buy Now" Special Announcement button that you see below the image at right. You will receive your free copy of Preferred Stock Investing within 3-7 postal days (US Postal Service shipping only, $5.65). The CDx3 Notification Service is, by far, the most comprehensive information resource for the highest quality preferred stocks anywhere. We do the research, you make the decisions. To read more about the CDx3 Notification Service, click here; but remember, if you want a free copy of Preferred Stock Investing with your individual subscription to the CDx3 Notification Service, use the "Buy Now" Special Announcement button at right to subscribe.

Brokers And Investment Groups: New Meeting Materials Now Available As the most comprehensive research service available for the highest quality preferred stocks, all of the large, and many smaller, brokerage firms subscribe to the CDx3 Notification Service. My Preferred Stock Investing Group Materials are intended for brokers with a group of clients or self-directed investment groups that are interested in learning something about preferred stock investing. The Preferred Stock Investing Group Materials include a slide show (27 slides, PowerPoint Show format) and an accompanying handout that provides my commentary for each slide. The handout is available in color and black and white (PDF format) for easy printing. The materials include my tips regarding how to select, buy and sell the highest quality preferred stocks and summarize much of the research from my book, Preferred Stock Investing. Specifically, the materials are organized into three parts: Part 1: Approach and Objectives To Preferred Stock Investing Part 2: How and When To Buy and Sell Preferred Stocks Part 3: Preferred Stock Investing Resources To request the Preferred Stock Investing Group Materials just send a blank email message to: InvestmentGroupMaterials@PreferredStockInvesting.com You will receive an auto-reply email message with current download instructions. |

|

||||||

|

Who Are These Companies That Issue CDx3 Preferred Stocks? Duke Realty Corporation (NYSE: DRE)

Duke Realty Corporation is a $2.6 billion Real Estate Investment Trust (REIT) founded in 1972 and headquartered in Indianapolis, Indiana. Duke's 114 million square feet of leasable space is primarily in the form of over 700 industrial office and warehouse facilities located in the Midwest and Southeast United States. Suburban job losses have affected Duke as much as the next real estate developer. A few months ago Duke took a $297.1 million non-cash impairment charge that has affected its short-term financials. Occupancy rates are down (now at 87% as oppose to about 89% at the end of 2008) and lease revenue is down compared to a year ago for most in this business, including Duke. And that's not likely to change for another year or two according to many experts. For investors counting on a quick strike from a company's short-term profits, Duke is probably not your first choice. Duke is investing and positioning itself for the long-haul and, as such, is much more attractive to many preferred stock investors. In less than one year Duke has simultaneously eased its debt pressures and retooled its property strategy. Here's a sample of some of Duke's actions over just the last few months: 1. There has been much written about the debt that many REITs have coming due, starting in 2010. On Friday, November 20 Duke announced that it has successfully renegotiated its $850 million unsecured revolving credit facility from maturing in January 2010 to a new maturity date of February 2013; 2. The weak U.S. dollar has created growing demand for U.S. exports. Duke has been selling off underperforming suburban office assets and part of its 6,400 acres of unencumbered land holdings and reinvesting the funds in sea port logistics buildings including 450,000 square feet at the Port of Savannah that is 100% leased. 3. A second area of investment for Duke has been healthcare-related facilities. While how we pay for healthcare may be up for debate, the fact that we need it is unchanged. In a joint venture with Northwestern Mutual Life, Duke has started construction on the new 450,000 square foot Baylor Cancer Center in Dallas. The new facility is over 90% pre-leased. And Duke has also done well to avoid volatile retail centers, a decision that has served them well during this recession. Less than 1% of Duke's consolidated square footage was in the form of retail space at the end of 2008 so their exposure here has been minimal. Duke's action plan announced in September 2009 includes increasing its industrial space holdings to 60% of its portfolio from the current 37%; tripling its healthcare facilities square footage and reducing commercial office space from 57% to less than 40% of its portfolio (source: Investor Update November 2009). You can see recent upgrade and downgrade activity for Duke by clicking here. Duke Realty Corporation is an issuer of CDx3 Preferred Stock. Reader Note: The purpose of the CDx3 Company Spotlight article is to give you a sense of the types of companies that issue CDx3 Preferred Stocks. Companies that appear in the CDx3 Company Spotlight either currently, or in the past, have issued CDx3 Preferred Stocks. Since I am not familiar with your financial goals, resources or risk tolerance, my mention of these companies here should not be taken as a recommendation by me for you to buy, or not buy, securities issued by these companies. |

|

||||||

|

If you purchase a preferred stock on the last day of its dividend quarter, how many days worth of dividend income will your dividend payment be for? - Preferred Stock Investing Reader's Forum. Any time that you purchase an investment you must have purchased it from someone else; that is, for every buyer there is a seller. It only seems fair that when you hold an investment for a certain period of time that you would be entitled to the portion of the earnings equal to the time you held the investment. That is, if an investment pays a return, such as a dividend, every three months, and I own the investment for one of those months, I should be entitled to one-third of that quarter's dividend. The person to whom I sold the investment would be entitled to the remaining two-thirds since he or she had their money on the line for that portion of the dividend period. Seems fair enough and this is exactly how bonds work. You receive the portion of the periodic earnings equal to the portion of time that you owned the bond. The person whom you purchased it from, or sold it to, gets the other portion. Let's say you purchase a preferred stock one day prior to the end of its 90 day dividend quarter. So the person that you purchased your preferred stock from owned it for 89 days then sold it to you the day before the "ex-dividend date." For the 90 day dividend quarter that is ending, you only own the preferred stock for one day (the last day) prior to the end of the quarter. If this was a bond we're talking about, the person from whom you purchased your shares would receive 89 days worth of the earnings from the bond while you would receive one day's worth. But what about preferred stocks? If you purchase shares of a preferred stock on the last day of the dividend quarter (and do not sell them again that day), how many days of that quarter's dividend earnings will you, versus the person you bought your shares from, receive?:

(A)

Only 1 day since that is the number of days that you owned the

preferred stock shares The answer is (B). Unlike bonds, the entire 90 day quarterly dividend payment of a preferred stock goes to whomever holds the shares on the morning of the ex-dividend date when the market opens. So if you purchase the shares the day prior to the ex-dividend date (and do not sell them to someone else that same day), you are going to receive the entire quarter's worth of dividend income, even though you only owned the shares for one day. A one day investment gets 90 days worth of return...Hmmm... Don't Try This At Home: If you are thinking that there must be a way to take advantage of this characteristic of preferred stocks, you are correct; there is. But let's be clear. I do not recommend trying this. Many of you probably remember the guy on the Ed Sullivan Show who would spin a bunch of dinner plates on the end of poles on stage. He would run around frantically, keeping all of the plates spinning so that none would fall off the poles. That's what your life would be like if you try this...but here it is. If you had a list of, say, ten preferred stocks, and you sorted that list by ex-dividend date, you could repeatedly buy and sell around each ex-dividend date, working your way down the list, and claim the 90 day dividend income for each one. You would only have your money in play for a total of ten days, but would collect 900 days worth of dividend income. Here's the downside risk: Per the Rule of Buyer/Seller Behavior (Preferred Stock Investing, page 43), the market price of a CDx3 Preferred Stock tends to fall in the early days of a new dividend quarter (i.e. starting on the ex-dividend date) since the next dividend payment is so far away. If that market price drop is more than the quarterly dividend that you just collected, you are losing money. Plus, doing this is a ton of work and would become very stressful; you really have to pay attention every day (keep the plates spinning). Who needs it? The preferred stock investing method explained throughout Preferred Stock Investing (the "CDx3 Income Engine") generates a nice return (consistently north of 10%) using the highest quality preferred stocks with no more effort than you spend reviewing your monthly bank statement. The CDx3 Income Engine is designed to meet three objectives - (1) maximize revenue while (2) minimizing risk and (3) minimizing work. Trying to take advantage of preferred stock ex-dividend dates, as interesting as it is, violates two of these three objectives. You can submit your own preferred stock question. If your question is used as the CDx3 Question Of The Month you will receive a free copy of the CDx3 Special Report "Dividend Accounting." |

|

||||||

|

Preferred Stock Market Research Now Available All Month Long - Free Automatic Email Delivery Of Preferred Stock Market Research Now Available Readers do not have to wait until next month's issue of the CDx3 Newsletter to stay plugged into the market for high quality preferred stocks. Preferred stock research articles, marketplace observations, questions from readers, preferred stock news from the financial press and other information are posted to the Preferred Stock Investing Reader's Forum (my "blog") throughout the month. In addition to the daily preferred stock news headlines, the Preferred Stock Marketplace Snapshot chart and other features, the following articles were recently posted on the Preferred Stock Investing Reader's Forum: November 20 - Preferred Stock Trading Symbol Cross-Reference Table November 10 - BBT-A vs BBT-B November 10 - Missed Dividend Payment November 09 - Beyond Call Date List November 09 - LEH-F

To receive articles by email automatically without having to visit the Forum, click here A separate window from FeedBurner (a Google service) will open on your screen. Enter and verify the email address that you want articles from the Forum to be emailed to as instructed. And don't worry - you'll never receive any spam from me and your email address will not be shared. By receiving the articles as I post them via email, you do not have to visit the Forum in order to stay plugged into my research regarding the marketplace for the highest quality preferred stocks. You are also invited to visit the Forum and comment on my articles or the comments and questions posted by other preferred stock investors. The new Preferred Stock Investing Reader's Forum is the most comprehensive (and free) news and information source specifically for preferred stock investors anywhere on the web. Please accept my invitation to receive articles by email and visit the Forum. |

|

||||||

|

How To Produce A "Self-Funding" CDx3 Portfolio In Today's CDx3 Preferred Stock Market It Takes Months, Not Years We've all experienced the miracle of compound interest. With a bank CD, your bank pays interest into your CD account every month then, the next month, you earn interest not only on the principal amount that you used to open the CD, but you also earn interest on those previous interest payments. Your interest starts earning interest. CDx3 Preferred Stock portfolios benefit from this compounding mechanism as well, but in a slightly different way. As your portfolio generates dividend income those dividends start piling up in your brokerage cash account. At some point, depending on the average annual dividend yield that your portfolio pays, you will accumulate enough dividend cash to buy your next CDx3 Preferred Stock without any "new" money from you. Using accumulated dividend cash to make your next CDx3 Preferred Stock purchase allows a preferred stock investor to realize the miracle of compounding. The CDx3 Preferred Stock that you purchased with accumulated dividends starts generating dividend cash of its own, so you start earning dividend income on your dividend income. The length of time that it takes for your preferred stock portfolio to reach this point of "self-funding" depends on the average dividend yield of your preferred stocks. The higher the average yield of your holdings, the sooner your portfolio will become self-funding. This chart shows you the number of months that it takes for your CDx3 Preferred Stock portfolio to become self-funding, depending upon your portfolio's average dividend yield. Notice that the higher the average dividend yield of your holdings, the sooner your portfolio will generate the cash needed to buy that next CDx3 Preferred Stock without any new money from you. You could have a self-funding CDx3 Preferred Stock portfolio by this time next year! |

|

||||||

Learn

to screen, buy and sell the highest

quality preferred stocks by

purchasing

the third edition of my book, Preferred

Stock Investing (see

retailers). The book identifies

the resources that you need to be a very

successful CDx3 Investor completely on

your own. If you would rather we do the

research and calculations for you I

offer the

CDx3 Notification Service.

Chapter

15 of Preferred Stock Investing

includes a list of all of the CDx3

Preferred Stocks issued since January

2001 and the investment results you

would have achieved had you invested in

them using the CDx3 Income Engine.

And

readers also receive free periodic

updates to the preferred stock lists in

chapter 15 as long as the Third Edition

of the book is in print.

Please

take a look at

www.PreferredStockInvesting.com.

And if you

know

someone who might be interested in simple

investing

for non-investment

experts please have them send an email

message to:

CDx3Newsletter@PreferredStockInvesting.com

and

they will automatically

begin receiving this monthly CDx3

Newsletter

next month (plus a

CDx3 Special Report) - all FREE. Many Happy Returns, Doug K. Le Du |

|

||||||

|

Copyright (c) 2009 by Doug K. Le Du CD Times 3, CDx3, CDx3 Income Engine, CDx3 Investor, CDx3 Portfolio, CDx3 Preferred Stock, CDx3 Perfect Market Index, CDx3 Bargain Table are trademarks of Doug K. Le Du. All rights reserved. Company logos are trademarks of the indicated companies. Service Marks (SM) are service marks of the indicated companies. DISCLAIMER: The content of this CDx3 Newsletter is to be regarded as educational, rather than advisory. There can always be exceptions to trends and/or generalizations that may be discussed herein. Consider your financial resources, goals and risk tolerance before investing. You, and not Doug K. Le Du, are solely responsible for your own investment decisions.

|

|||||||

|

|

|

|

|

|

|||

For

New Readers...

For

New Readers...